Best Crypto Tools for Research & Analysis 2024

The cryptocurrency market is like a wild, unpredictable beast—constantly shifting, evolving, and often catching traders off guard. If you’ve ever found yourself staring at a screen full of candlesticks, wondering what on earth they’re telling you, you’re not alone. The key to taming this beast lies in using the right crypto analysis tools. In 2024, with an ever-expanding array of tools and platforms available, having the best crypto analysis tools in your arsenal can turn the tides in your favor, giving you the edge you need to navigate this volatile market.

Why Do You Need Crypto Analysis Tools?

Navigating the ups and downs of the crypto market without a clear strategy is like sailing through a storm without a compass. Crypto analysis tools provide the insights and data needed to make informed decisions rather than relying on guesswork. Whether you’re tracking market sentiment, analyzing price trends, or managing your crypto portfolio, these tools can be game-changers for traders at any level.

Key Features to Look for in the Best Crypto Analysis Tools

When selecting the best crypto analysis tools, it’s essential to consider features that will support your trading style and goals. Here’s what to keep an eye out for:

Real-Time Data and Alerts

In the world of crypto trading, timing is everything. Tools that offer real-time data and instant alerts keep you in the loop on price changes, market news, and key events that can impact your investments. This feature is crucial for making quick, informed decisions.

User-Friendly Interface

A tool’s usability can make or break your trading experience. Look for platforms with clean, intuitive interfaces that allow you to access data and execute trades without unnecessary complexity. After all, the last thing you want is to lose money because you couldn’t figure out how to use the software!

Advanced Charting Tools

Advanced charting tools are the bread and butter of crypto analysis. Look for customizable charts with a variety of indicators, such as moving averages, RSI, and MACD. These tools help you visualize data in a way that highlights trends and opportunities, providing a solid foundation for your trading decisions.

Comprehensive Analytics and Indicators

The best tools offer a wide range of analytics and indicators to suit all kinds of analysis, from basic to advanced. This includes everything from simple price tracking to complex on-chain analytics, which can provide a deeper look at market sentiment and investor behavior.

Security and Privacy Considerations

Given the value of your data, security is paramount. Choose platforms that prioritize user security with strong encryption and privacy protocols, ensuring your sensitive information stays protected.

Top Crypto Research Tools for 2024

With so many crypto analysis tools available, finding the right one can feel overwhelming. Here’s a look at the top crypto tools for 2024 that stand out due to their features, user experience, and ability to deliver actionable insights.

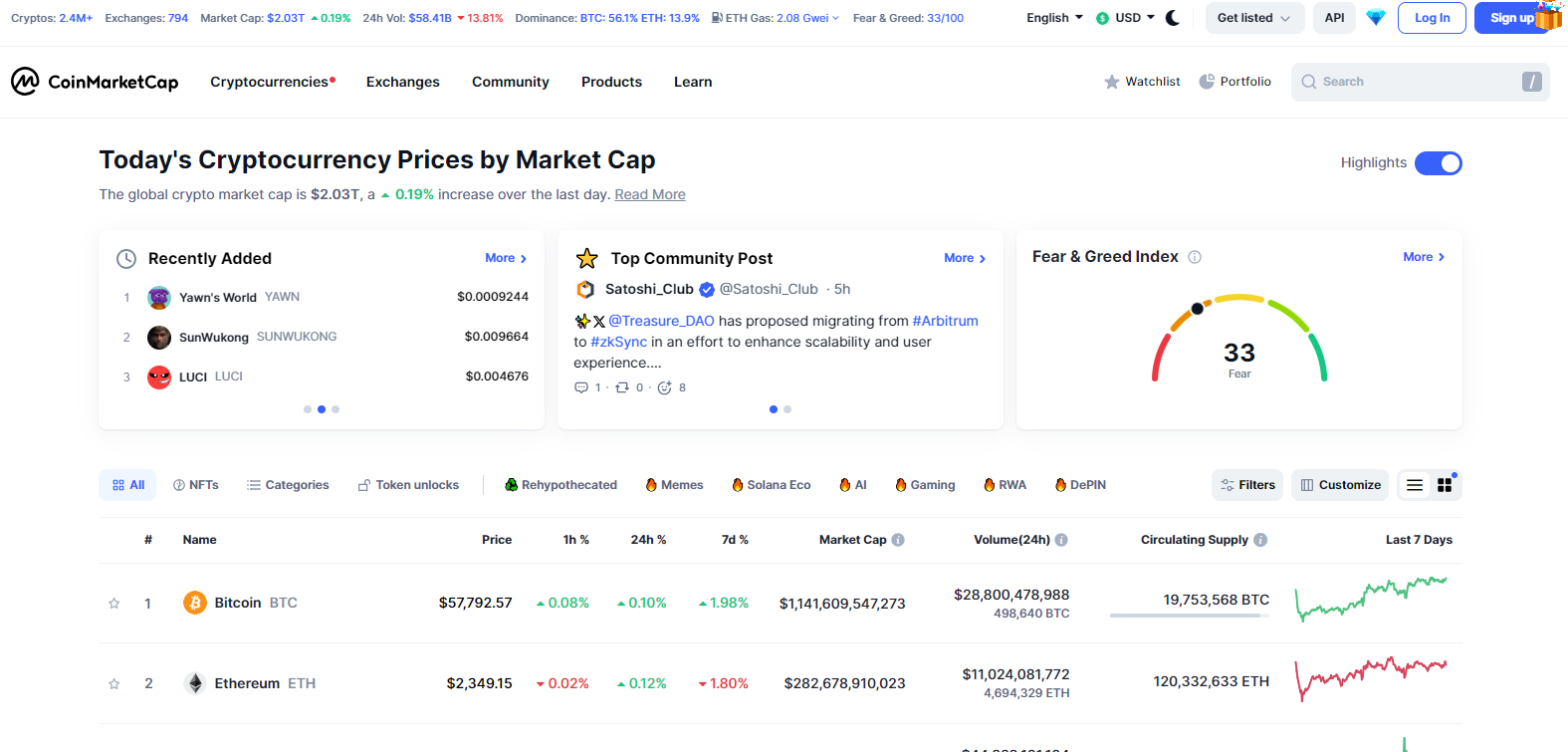

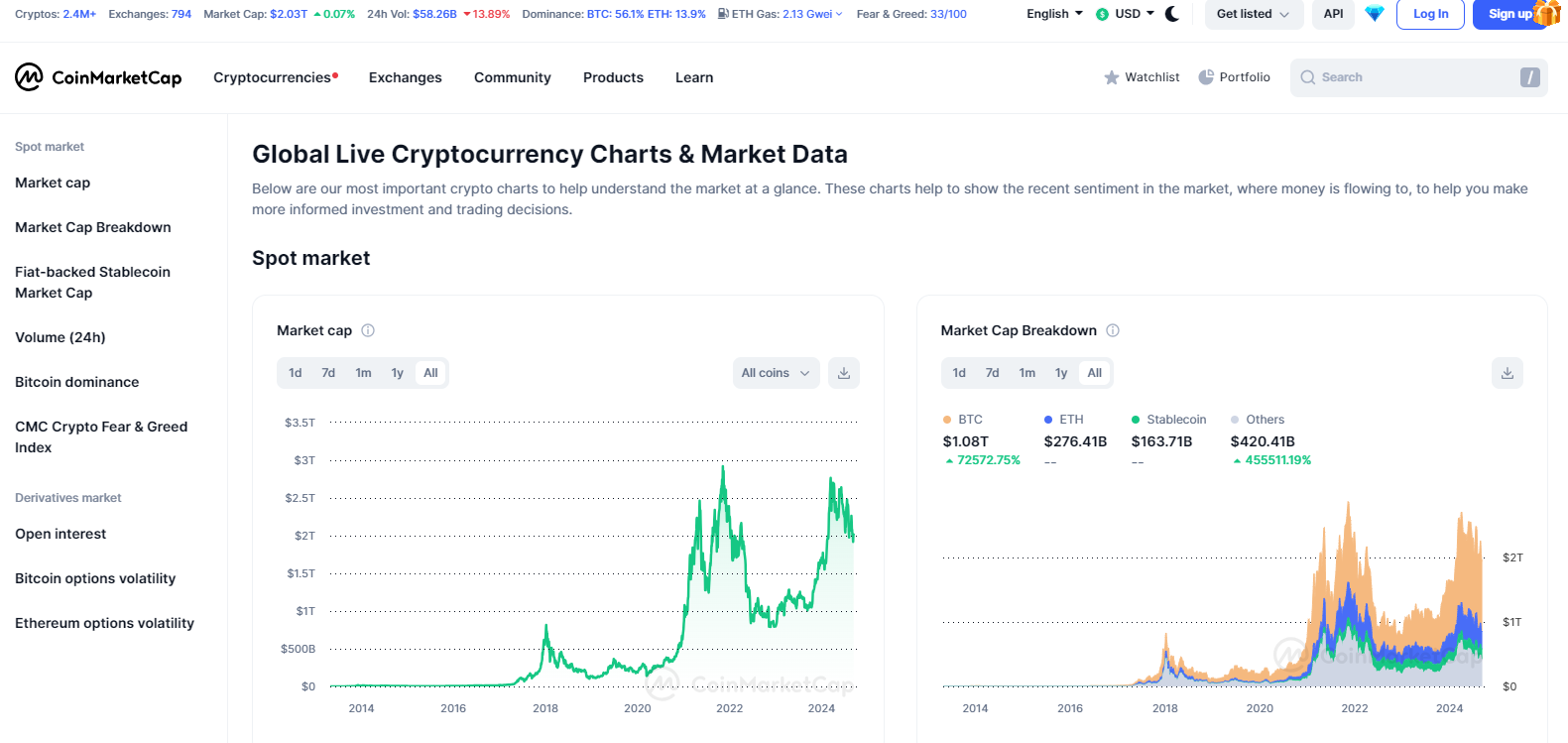

1. CoinMarketCap

CoinMarketCap remains a staple for anyone tracking the performance of cryptocurrencies. It’s one of the most popular and trusted crypto research tools in the market.

Features

- Provides real-time data on prices, market cap, and trading volume.

- Includes educational resources and news updates, making it a good starting point for beginners.

Pros and Cons

- Pros: Reliable and extensive data coverage; user-friendly interface.

- Cons: Limited advanced charting and analysis features.

Best Use Cases

- Ideal for tracking price movements and setting up watchlists, making it one of the best free crypto tools for beginners.

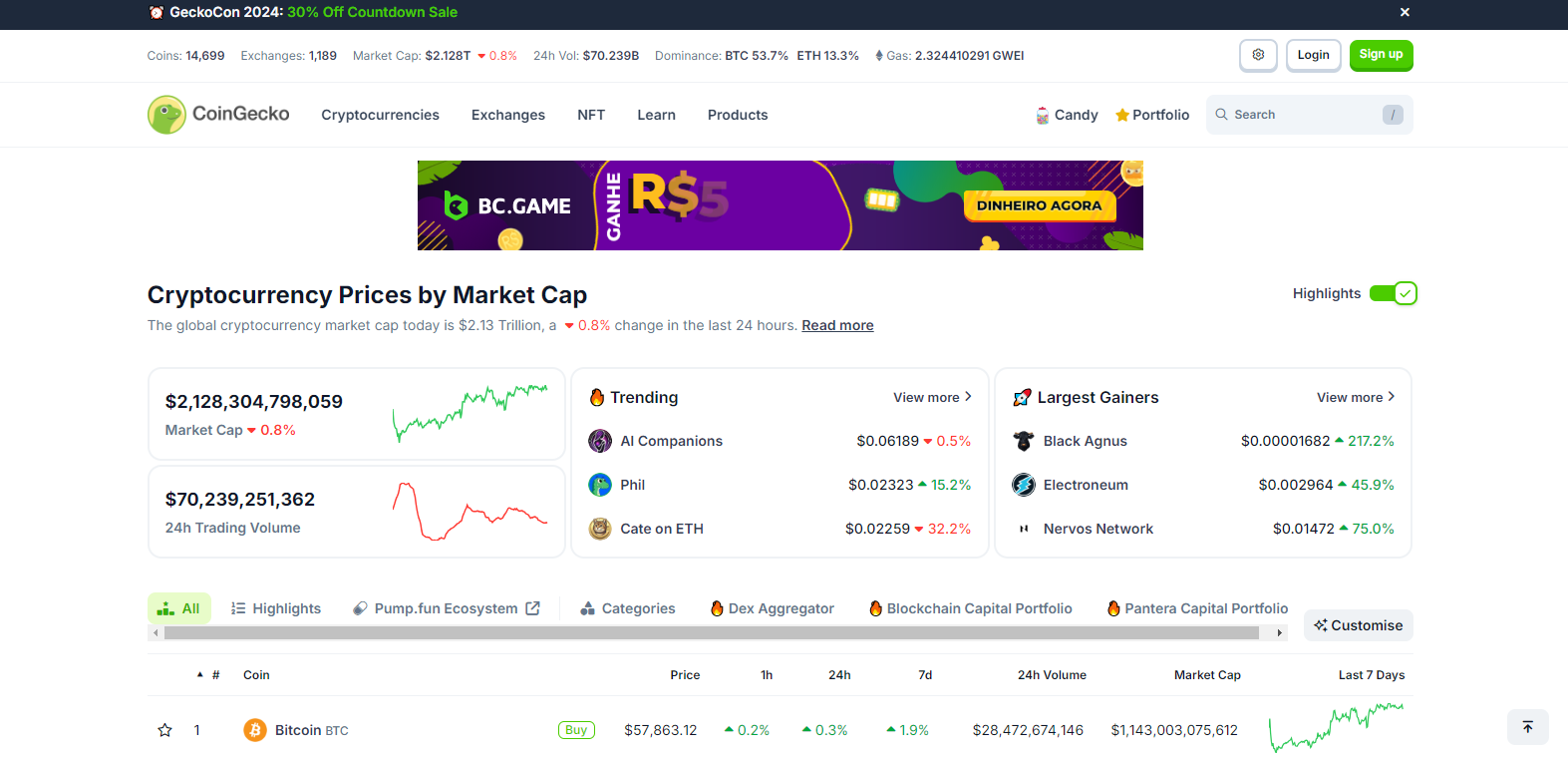

2. CoinGecko

CoinGecko offers similar services to CoinMarketCap but with additional data points, such as community ratings and developer activity. It’s a great tool for those looking to dive deeper into the cryptocurrency market insights.

Features

- Tracks over 6,000 cryptocurrencies, providing detailed information including liquidity and developer data.

- Offers advanced analytics, especially useful for DeFi enthusiasts.

Pros and Cons

- Pros: Comprehensive data, including community and developer insights.

- Cons: The interface may be overwhelming for first-time users.

Best Use Cases

- Perfect for users looking to explore beyond price tracking, including DeFi and community-driven metrics.

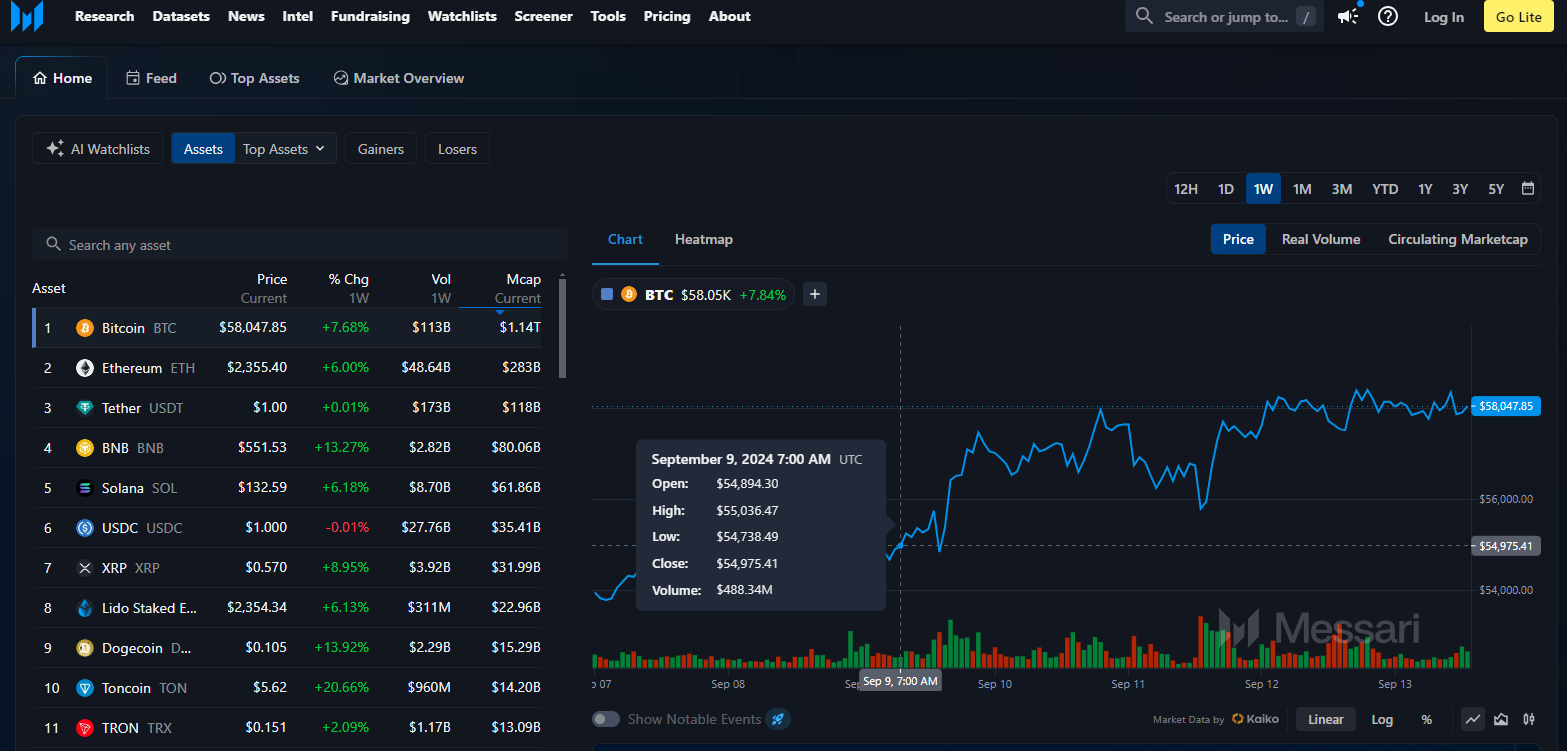

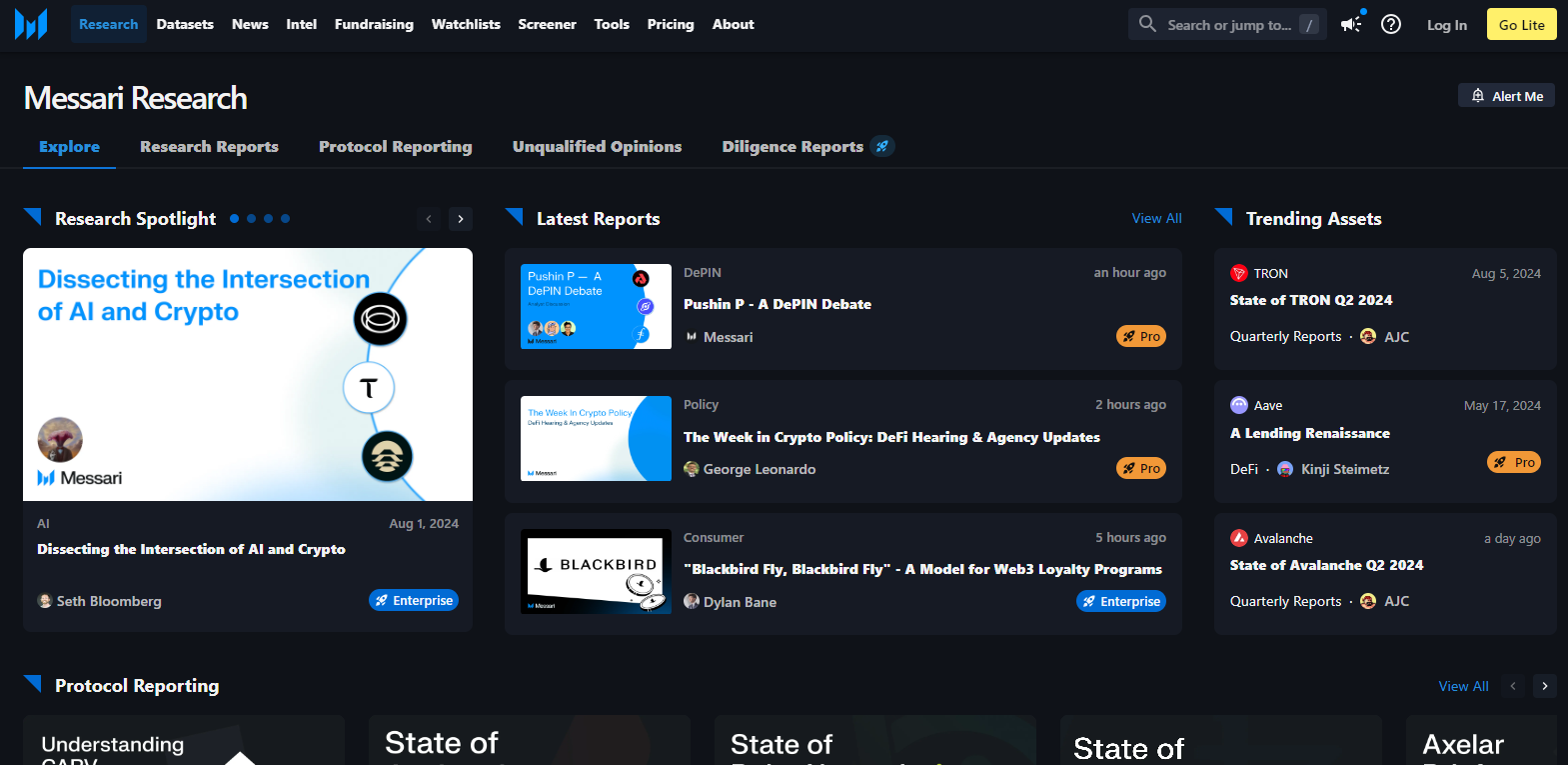

3. Messari

For professional-grade research and in-depth market analysis, Messari stands out among the best crypto tools of 2024. It offers detailed reports and advanced data analytics tailored for serious investors.

Features

- Provides access to high-quality research reports and a comprehensive screener for finding investment opportunities.

- Includes real-time news and insights directly from the crypto market.

Pros and Cons

- Pros: In-depth research and professional-grade analytics.

- Cons: Subscription-based, which can be costly for casual users.

Best Use Cases

- Ideal for professional investors seeking detailed analysis and market insights.

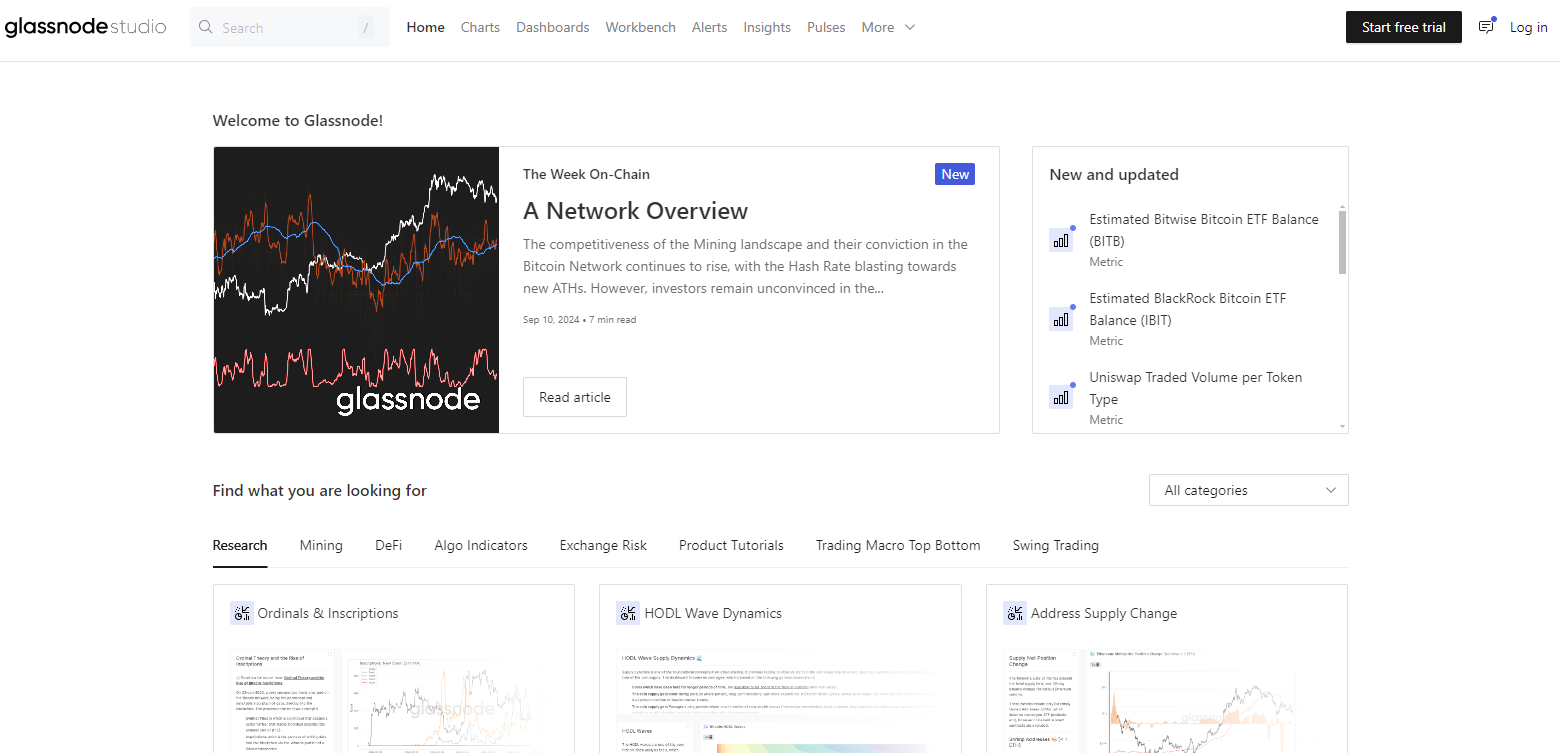

4. Glassnode

Glassnode is a leading on-chain analytics tool that offers a wealth of data, helping traders understand blockchain activity at a deeper level.

Features

- Provides a wide range of on-chain metrics and visualizations.

- Offers insights into market sentiment and investor behavior.

Pros and Cons

- Pros: Comprehensive on-chain data; detailed visualizations.

- Cons: Can be complex for beginners and some features are behind a paywall.

Best Use Cases

- Excellent for traders who rely on on-chain data to inform their strategies, making it one of the top blockchain analysis tools available.

5. IntoTheBlock

IntoTheBlock uses machine learning to provide advanced crypto analysis, offering unique insights into the market that other tools may miss.

Features

- Machine learning-powered analytics that cover on-chain data, exchange data, and sentiment analysis.

- Customizable dashboards allow for tailored data viewing.

Pros and Cons

- Pros: Advanced analytics powered by machine learning; customizable interface.

- Cons: The advanced nature of the tool may be intimidating for new users.

Best Use Cases

- Perfect for data-driven investors looking to leverage machine learning for more accurate predictions.

6. Dune Analytics

Dune Analytics is a community-driven platform where users can create custom data analysis on blockchain data, making it one of the most flexible tools in the space.

Features

- Allows for custom SQL queries and visualizations, making it highly customizable.

- Real-time blockchain data that’s updated frequently.

Pros and Cons

- Pros: Customizable and community-driven; real-time updates.

- Cons: Requires knowledge of SQL for custom queries, which can be a barrier for some users.

Best Use Cases

- Ideal for DeFi enthusiasts and those looking to conduct in-depth custom analyses on blockchain data.

7. TradingView

TradingView is not just for stocks—it’s also one of the best tools for crypto investors, offering advanced charting tools and a social platform for traders.

Features

- Provides advanced charting and technical analysis tools.

- Includes social features that allow users to share trading ideas and strategies.

Pros and Cons

- Pros: Powerful charting capabilities; active community of traders.

- Cons: Some premium features are behind a paywall.

Best Use Cases

- Great for technical analysis and connecting with other traders for insights and strategies.

8. CryptoQuant

CryptoQuant offers a range of on-chain analytics and market insights, making it a popular choice among traders looking to understand the flow of funds in the market.

Features

- Provides data on exchange flows, miner data, and other market-moving metrics.

- Includes custom alerts to keep traders informed of significant market changes.

Pros and Cons

- Pros: Detailed on-chain data; reliable insights.

- Cons: Some features require a subscription.

Best Use Cases

- Perfect for traders who need to track the flow of funds in the crypto market, especially around key events.

9. Nansen

Nansen is a blockchain analytics platform that specializes in tracking wallet activities and providing insights into DeFi and NFT markets.

Features

- Tracks wallet activities and offers real-time insights into DeFi and NFTs.

- Provides detailed dashboards and alerts.

Pros and Cons

- Pros: Detailed wallet tracking; valuable for DeFi and NFT analysis.

- Cons: Limited to Ethereum-based assets; can be pricey.

Best Use Cases

- Great for those interested in wallet activities and the DeFi landscape, offering insights that are crucial for active traders.

How to Choose the Best Crypto Tool for Your Needs

With so many options, selecting the best crypto analysis tool can be challenging. Here are a few tips to help you make the right choice:

Assessing Your Needs

Identify your primary needs—whether it’s basic tracking, advanced on-chain analytics, or technical analysis. Understanding what you need will narrow down your options.

Comparing Features

Review the features of each tool, compare them against your needs, and consider trying out free trials to get a feel for the interface and functionality.

Future Trends in Crypto Tools

As technology advances, the landscape of crypto analysis tools continues to evolve. Here are some exciting trends to watch in 2024:

AI and Machine Learning in Crypto Analysis

AI and machine learning are increasingly becoming a part of crypto research tools, offering predictive analytics and more precise insights.

Integration with Decentralized Finance (DeFi)

Expect more tools to integrate with DeFi platforms, providing direct access to financial products like lending, borrowing, and staking directly from the tool.

How to Choose the Right Crypto Analysis Tool for Your Needs

Choosing the best crypto analysis tools depends on your specific needs and trading style. Are you a technical trader who needs advanced charting capabilities? Or perhaps you’re an investor looking for fundamental analysis tools to gauge the long-term potential of a project? Consider what features align best with your goals and whether you’re willing to invest in paid tools for additional functionality.

Conclusion

Having the right crypto tools is essential in 2024, whether you’re a beginner looking for basic market insights or a seasoned trader seeking advanced analytics. From CoinMarketCap to Glassnode, the tools listed here offer a variety of features that cater to different needs. The key is to find the one that aligns best with your goals and trading style, allowing you to make informed decisions in the dynamic world of cryptocurrency.

FAQs

1. What is the best free crypto research tool?

CoinMarketCap and CoinGecko are excellent free options that provide comprehensive data and are easy to use for beginners.

2. How can beginners start with crypto analysis?

Beginners should start with user-friendly platforms like CoinMarketCap or TradingView, which offer essential tools for learning the basics of market tracking and technical analysis.

3. Are paid crypto tools worth the investment?

Paid tools like Messari and Glassnode offer advanced features and detailed analysis, which can be very beneficial for serious traders looking to gain a competitive edge.

4. How often should I use these tools for analysis?

It depends on your trading activity, but regular use—daily or weekly—can help keep you updated with the latest market trends and data.

5. Can these tools guarantee success in crypto trading?

No tool can guarantee success, as the crypto market is highly unpredictable. However, these tools provide valuable insights that can improve your decision-making process.

6. How can I keep my data secure while using these platforms?

Always use platforms with robust security measures, including encryption and two-factor

7. Can I use multiple crypto analysis tools simultaneously?

Yes! Using a combination of tools can provide a more comprehensive view of the market, allowing you to incorporate different types of analysis for more informed trading decisions.