Elliott Wave Theory – Rules and Principles

Navigating the financial markets can feel like trying to predict the weather: sometimes, it’s sunny, other times, stormy, and often, it’s downright unpredictable. But what if there was a way to read the ‘weather patterns’ of the market? Enter the Elliott Wave Theory, a fascinating approach to market analysis that combines psychology, pattern recognition, and a bit of math. Whether you’re new to trading or a seasoned pro, understanding this theory could give you a clearer view of where the market might be heading.

History of Elliott Wave Theory

The story of Elliott Wave Theory begins in the 1930s with Ralph Nelson Elliott, an accountant who, during his retirement, observed that stock markets did not behave in a chaotic, random manner. Instead, he noticed patterns that repeated over time. Elliott proposed that these patterns, or “waves,” reflected the collective psychology of market participants. He published his findings in a series of articles and books, most notably “The Wave Principle,” and the rest, as they say, is history. Today, Elliott’s insights have been embraced by traders worldwide, and his wave theory has become a staple in technical analysis.

Basic Principles of Elliott Wave Theory

At its core, Elliott Wave Theory is all about understanding crowd psychology. It’s based on the idea that market prices move in predictable cycles that reflect the emotions and actions of investors. These cycles, or waves, are driven by the alternating periods of optimism and pessimism in the market. Essentially, when people feel good about an asset, they buy, pushing prices up, and when they feel bad, they sell, driving prices down.

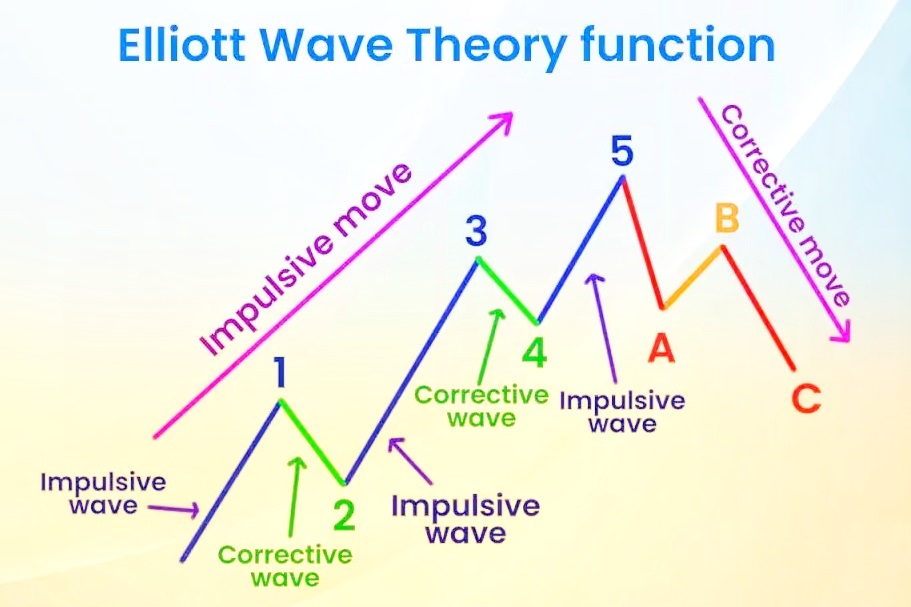

The Five-Wave Pattern

One of the key components of Elliott Wave Theory is the Five-Wave Pattern, also known as impulse waves. This pattern consists of five distinct waves that move in the direction of the prevailing trend: three waves moving in the direction of the trend (waves 1, 3, and 5) and two waves moving against it (waves 2 and 4). The third wave is typically the strongest and most recognizable. Understanding these patterns can help traders spot potential entry and exit points in a trending market.

The Three-Wave Corrective Pattern

After every five-wave impulse, the market undergoes a corrective phase, typically in the form of a Three-Wave Pattern (A, B, and C). This corrective wave moves against the trend and is usually a retracement of the previous five-wave advance. Unlike the impulse waves, corrective waves are generally shorter and less intense, reflecting a temporary pause or pullback in the prevailing trend.

Types of Waves

Elliott Wave Theory categorizes waves into two main types: Motive Waves and Corrective Waves. Motive waves are those that move in the direction of the larger trend and include both impulse and diagonal waves. Corrective waves, on the other hand, move against the trend and include zigzags, flats, and triangles. Understanding these wave types is crucial for accurately analyzing and predicting market movements.

Wave Degrees and Fractals

One of the fascinating aspects of Elliott Wave Theory is its fractal nature. This means that waves are composed of smaller waves of the same structure, repeating at various degrees. From the smallest scale (subminuette) to the largest (grand supercycle), each wave fits into a broader pattern, like Russian nesting dolls. This fractal concept is what allows Elliott Wave Theory to be applied across different time frames, from minutes to decades.

Elliott Wave Rules and Guidelines

Elliott Wave Theory comes with a set of rules and guidelines to help traders correctly identify wave patterns. Here are the three cardinal rules:

- Wave 2 cannot retrace more than 100% of Wave 1.

- Wave 3 cannot be the shortest of the three impulse waves (1, 3, and 5).

- Wave 4 cannot overlap Wave 1, except in specific situations like diagonal patterns.

These rules, along with other guidelines like the alternation principle and Fibonacci relationships, help traders validate their wave counts and make more informed decisions.

Common Patterns and Variations

Elliott Wave Theory is not limited to just basic five-wave impulses and three-wave corrections. It includes a variety of patterns, such as Zigzags, Flats, and Triangles. Zigzags are sharp corrections typically seen in a strong trend, flats are sideways corrections, and triangles are consolidations that often occur before the final wave in a sequence. Understanding these patterns and their variations can significantly enhance your market analysis skills.

Applying Elliott Wave Theory in Trading

Now that you understand the basics, how do you apply Elliott Wave Theory in real-world trading? The key lies in market forecasting. By identifying the current wave pattern, traders can anticipate the next move in the market. Whether you’re trading stocks, forex, or cryptocurrencies, recognizing wave patterns can help you enter trades at the start of a new impulse wave or exit before a major correction.

Tools and Software for Elliott Wave Analysis

Gone are the days when traders had to manually count waves on paper charts. Today, there are numerous tools and software platforms that can assist with Elliott Wave analysis. Popular platforms like MetaTrader, TradingView, and Elliott Wave International provide advanced charting tools and automated wave counting features that make it easier for traders to apply the theory in their analysis.

Limitations and Criticisms

Like any trading strategy, Elliott Wave Theory is not without its critics. Some argue that wave patterns are too subjective, leading to inconsistent results. Others point out that the theory’s reliance on historical price data can limit its predictive power in rapidly changing markets. It’s important to use Elliott Wave Theory as one part of a broader trading strategy, complementing it with other technical and fundamental analysis tools.

Tips for Beginners

If you’re new to Elliott Wave Theory, it can feel overwhelming at first. Start by learning the basic patterns and rules, and practice identifying waves on historical charts. There are plenty of online resources, courses, and communities dedicated to Elliott Wave analysis that can help you get started. Remember, like any skill, mastering Elliott Wave Theory takes time, patience, and practice.

Success Stories and Case Studies

Throughout the years, many successful traders have used Elliott Wave Theory to their advantage. For example, hedge fund manager Paul Tudor Jones famously used Elliott Wave analysis to predict the 1987 stock market crash, earning him a spot among the top traders of his time. Case studies like these illustrate the potential of Elliott Wave Theory when used correctly.

Conclusion

Elliott Wave Theory offers a unique way to understand market movements by analyzing the patterns created by investor psychology. While it may not be a crystal ball, it’s a powerful tool that, when used correctly, can provide valuable insights into market trends and potential reversals. As with any trading strategy, the key is to practice, stay disciplined, and always keep learning. The future of Elliott Wave Theory looks bright, especially as technology continues to evolve, making wave analysis more accessible to traders of all levels.

FAQs

- What is the main idea behind Elliott Wave Theory?

Elliott Wave Theory is based on the idea that market prices move in predictable patterns, or waves, that reflect the collective psychology of investors.

- Can Elliott Wave Theory be used in all financial markets?

Yes, Elliott Wave Theory can be applied to any market with a reliable price history, including stocks, forex, commodities, and cryptocurrencies.

- How accurate is Elliott Wave Theory in predicting market movements?

While Elliott Wave Theory can be highly accurate when applied correctly, it is not foolproof. It’s best used in conjunction with other analysis tools.

- Do I need special software to use Elliott Wave Theory?

While not required, using specialized software like MetaTrader or TradingView can make it easier to identify and analyze wave patterns.

- Is Elliott Wave Theory difficult to learn?

It can be challenging at first due to the complexity of patterns and rules, but with practice and the right resources, it becomes easier to understand and apply.