How to Create Your Own Trading Strategies

Trading successfully in any market requires more than just luck. At the heart of every successful trader’s journey is a personalized trading strategy that aligns with their goals, risk tolerance, and lifestyle. This guide will show you how to create your own trading strategy that works for you, whether you’re trading in the stock market, Forex, or cryptocurrency.

What is a Trading Strategy?

At its core, a trading strategy is a plan that outlines your entry and exit points in the market, how much risk you’re willing to take, and your desired outcomes. It’s your personalized roadmap that guides your decision-making, helps you stay disciplined, and prevents emotional decisions.

Without a strategy, trading can feel like wandering through a forest without a map. But with the right plan, you can turn uncertainty into opportunity.

Why Create a Personalized Trading Strategy?

While there are countless trading strategies available online, creating your own gives you the flexibility to tailor it to your unique needs. Whether you’re day trading, swing trading, or holding long-term positions, a custom trading strategy will help you achieve your financial goals in a way that fits your lifestyle.

Benefits of Building Your Own Strategy:

- Flexibility: You can adjust your strategy to different markets, such as Forex, cryptocurrency, or stocks.

- Control Over Risk: You set your own risk tolerance, so you’re comfortable with your decisions.

- Consistency: A personalized plan helps keep you on track and prevents impulsive trades driven by emotions like fear or greed.

Understanding the Basics of Trading

Before diving into creating your own strategy, it’s crucial to understand the basics of trading across different markets. Whether you’re in the stock market, Forex market, or trading cryptocurrencies, knowing these fundamentals will give you a solid foundation.

Types of Markets You Can Trade In

- Stock Market: Buying and selling shares of publicly listed companies.

- Forex Market: Trading currency pairs such as USD/EUR.

- Cryptocurrency: Digital currencies like Bitcoin and Ethereum.

- Commodities: Trading physical goods like gold or oil.

Key Trading Terminology

- Bull Market: When prices are rising.

- Bear Market: When prices are falling.

- Leverage: Borrowing money to increase potential returns.

Step 1: Defining Your Trading Goals

The first step in building a trading strategy is setting clear, achievable goals. Ask yourself: what do you want to accomplish with your trades?

Short-Term vs Long-Term Trading

- Day Trading: Involves making multiple trades throughout the day. This is for people who enjoy quick decisions and fast results.

- Swing Trading: Holding positions for several days or weeks. It’s a balance between day trading and long-term investing.

- Long-Term Investing: Holding positions for months or even years, focusing on long-term growth.

What Are Your Financial Goals?

Your goals will influence the type of strategy you create. Are you looking to generate extra income on the side, or are you trying to grow your wealth over the long haul? Knowing your goals helps you make better decisions and choose the right trading timeframe.

Step 2: Choosing the Right Market

Once you’ve set your goals, you need to choose which market to trade in. Different markets suit different personalities and risk tolerances.

Stock Market

The stock market is a great starting point for beginners. It’s relatively stable and well-regulated, with plenty of resources available to help you understand how to trade stocks.

Forex Market

If you’re looking for a market with high liquidity and fast-moving opportunities, Forex trading could be your best option. Keep in mind that it comes with higher risks due to the volatility of currency pairs.

Cryptocurrency

Digital currencies are known for their rapid price movements, which can lead to substantial gains—or losses. If you’re comfortable with higher risks and enjoy the thrill of fast-paced trading, cryptocurrency trading might be your go-to market.

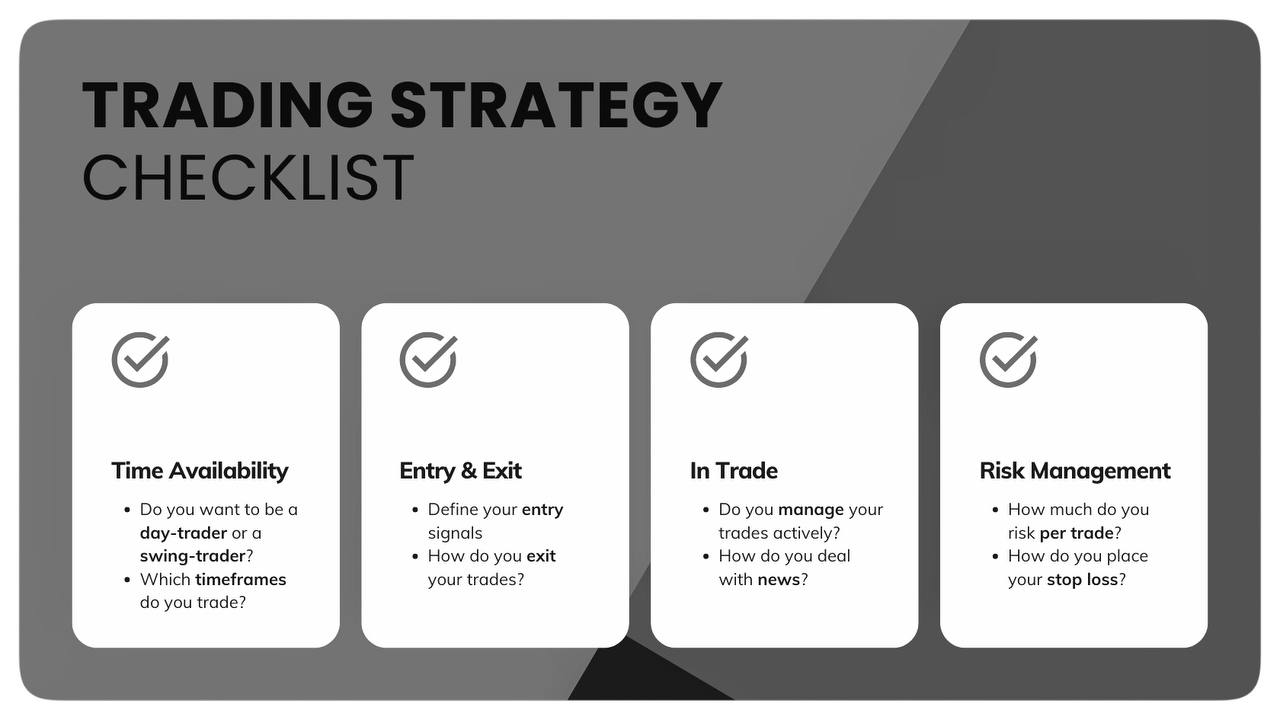

Step 3: Understanding Your Risk Tolerance

Every trader has a different comfort level with risk. Understanding your risk tolerance is essential because it shapes the kinds of trades you make.

How to Measure Risk Tolerance

Think about how much you’re willing to lose on a trade. Are you comfortable with small, consistent losses in exchange for potential large wins? Or do you prefer safe, steady growth, even if it means smaller returns? By understanding your risk tolerance, you can choose the right approach, whether you’re focusing on Forex, stocks, or crypto.

Step 4: Choosing the Right Tools

To execute your strategy effectively, you’ll need the right tools. These include trading platforms and technical analysis tools that help you identify trends and make data-driven decisions.

Popular Trading Platforms

- MetaTrader 4/5: Widely used for Forex trading, with built-in backtesting tools.

- ThinkorSwim: Known for its advanced charting tools, great for stock traders.

- Binance: Ideal for cryptocurrency traders due to its wide range of available digital assets.

Technical Indicators to Consider

- Moving Averages: These help identify trends.

- Relative Strength Index (RSI): Indicates overbought or oversold conditions.

- Bollinger Bands: Show volatility in the market.

Step 5: Deciding on Your Trading Timeframe

Your trading timeframe will dictate how often you buy and sell. Matching your timeframe with your lifestyle is crucial for maintaining consistency.

Day Trading, Swing Trading, or Position Trading?

- Day Trading: Best for those who want quick results and have time to monitor the markets constantly.

- Swing Trading: Works well for people with full-time jobs who want to make trades over days or weeks.

- Position Trading: Ideal for long-term traders who prefer a “buy and hold” strategy.

Step 6: Setting Entry and Exit Rules

Now that you’ve defined your goals, chosen your market, and selected your tools, it’s time to establish rules for entering and exiting trades.

Choosing Entry Points

Your entry points should be based on technical indicators such as:

- Moving Averages: These help identify the best time to enter a trade by spotting trends.

- MACD: A popular indicator that signals trend reversals.

Exit Strategies

An effective exit strategy helps lock in profits or minimize losses. Consider using:

- Stop-Loss: Automatically closes your trade if the market moves against you.

- Take-Profit: Automatically closes the trade when you reach a predefined profit level.

Step 7: Backtesting Your Strategy

Before you dive into live trading, it’s crucial to backtest your strategy using historical data. Backtesting helps you see how your strategy would have performed in the past and highlights any weaknesses.

How to Backtest Effectively

Platforms like MetaTrader allow you to simulate your strategy in past market conditions. This can reveal whether your entry and exit points, risk management, and timeframe work well together.

Step 8: Monitoring and Improving Your Strategy

Once you’ve started live trading, it’s important to regularly monitor your performance and tweak your strategy as needed. This doesn’t mean overhauling your plan every time you experience a loss, but making small adjustments based on solid data.

Tracking Your Performance

Keep a journal of your trades, noting what worked and what didn’t. Over time, you’ll start to see patterns that can inform improvements to your strategy.

Common Mistakes to Avoid

Even seasoned traders can make mistakes. By avoiding these common pitfalls, you’ll set yourself up for success:

Overcomplicating Your Strategy

When starting, it’s tempting to use as many technical indicators as possible, but simpler is often better. Stick to a few key metrics that you understand well.

Ignoring Emotional Discipline

Trading can trigger strong emotions like fear or greed, which often lead to poor decisions. Your strategy exists to prevent emotion-driven trades, so trust it.

Finalizing Your Trading Plan

With your strategy in place, the final step is creating a comprehensive trading plan. This is your personal guidebook, outlining your goals, risk tolerance, tools, and rules. Stick to it!

Documenting Your Strategy

Write down your trading plan, including everything from your goals to your exit rules. This serves as your roadmap to keep you focused.

Conclusion

Creating a custom trading strategy isn’t as daunting as it might seem. By following these steps—defining your goals, understanding your risk tolerance, choosing the right market and tools, and establishing clear entry and exit rules—you’ll be well on your way to trading success. Remember, consistency and discipline are key. As long as you stick to your plan, you’ll be able to navigate the ever-changing markets with confidence.

FAQs

- What’s the best trading strategy for beginners?

A simple strategy like swing trading in the stock market can be a great start for beginners. - How do I know if my trading strategy is working?

Consistently profitable trades over time and minimal losses indicate a working strategy. - Can I use multiple strategies?

Yes! Many traders use different strategies for different markets or timeframes. - How often should I adjust my strategy?

Review your strategy every few months or whenever market conditions significantly change. - Is backtesting necessary for every strategy?

Absolutely! Backtesting helps you evaluate the effectiveness of your strategy before risking real money.