Ichimoku Cloud Indicator and Strategies

When it comes to technical analysis, there’s one tool that often gets traders excited: the Ichimoku Cloud. Whether you’re new to trading or have some experience under your belt, this comprehensive indicator can help you understand market trends, pinpoint entry and exit points, and ultimately, make better trading decisions. But what exactly is the Ichimoku Cloud, and how can you use it effectively? Let’s dive in and explore this fascinating tool in depth.

What is Ichimoku Cloud?

The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a versatile technical analysis indicator that combines multiple components to give traders a clearer picture of market trends, momentum, and potential support and resistance levels. Unlike simple moving averages or oscillators, Ichimoku Cloud presents data in a holistic way, allowing traders to see the bigger picture at a glance. It’s like having a weather forecast for your trading decisions!

History and Origin of Ichimoku Cloud

The Ichimoku Cloud was developed by Goichi Hosoda, a Japanese journalist, in the late 1930s and was officially published in 1969. Hosoda spent decades fine-tuning this indicator, aiming to create a tool that could offer a quick glance at the market’s equilibrium or “at a glance” view, hence the name Ichimoku Kinko Hyo. The system was initially designed for trading Japanese rice futures but has since become popular among traders worldwide, across various markets.

Why Use Ichimoku Cloud in Trading?

Why should you consider using the Ichimoku Cloud? Simply put, it provides a detailed view of market dynamics, all in one indicator. This can save you time and reduce the need for multiple charts cluttered with various indicators. It’s particularly popular among trend traders because it helps identify the direction and strength of trends. Plus, it’s visually intuitive—once you get the hang of it, the Ichimoku Cloud can make your chart analysis both quicker and more accurate.

The Components of Ichimoku Cloud

Before we dive into strategies, it’s important to understand the components of the Ichimoku Cloud. Each element of this indicator serves a specific purpose, and together, they create a comprehensive view of the market.

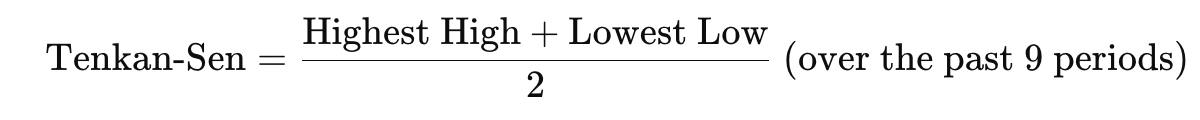

Tenkan-Sen (Conversion Line)

The Tenkan-Sen, or Conversion Line, is essentially a faster moving average that helps identify the short-term trend. It is calculated by taking the average of the highest high and the lowest low over the past nine periods.

Calculation and Interpretation

To calculate Tenkan-Sen:

When the Tenkan-Sen crosses above the Kijun-Sen (Base Line), it generates a bullish signal, and when it crosses below, it indicates a bearish signal.

Kijun-Sen (Base Line)

The Kijun-Sen, or Base Line, is a slower moving average that shows the medium-term trend. It’s calculated in a similar manner to the Tenkan-Sen but uses a longer period, typically 26 periods.

Calculation and Interpretation

To calculate Kijun-Sen:

The Kijun-Sen acts as an indicator of market momentum. If prices are above the Kijun-Sen, the trend is considered bullish, and if below, bearish.

Senkou Span A & B (Leading Spans)

Senkou Span A and Senkou Span B together form the Kumo, or “cloud,” which is the most recognizable part of the Ichimoku Cloud.

Understanding the Cloud (Kumo)

- Senkou Span A: Calculated as the average of the Tenkan-Sen and Kijun-Sen, projected 26 periods into the future.

- Senkou Span B: Calculated as the average of the highest high and the lowest low over the past 52 periods, projected 26 periods into the future.

The space between Senkou Span A and B forms the Kumo. A thicker cloud suggests stronger support or resistance, while a thin cloud indicates weaker levels.

Chikou Span (Lagging Span)

The Chikou Span is the closing price plotted 26 periods behind the current price. It helps confirm trends and potential reversals.

How to Use Chikou Span in Trading

If the Chikou Span is above the current price, it’s a bullish signal, and if below, it’s bearish. It’s a simple yet effective way to validate signals from other components.

How to Set Up Ichimoku Cloud on Your Charts

Setting up the Ichimoku Cloud on your charts is straightforward, whether you’re using popular platforms like TradingView, MetaTrader, or others.

Step-by-Step Guide for Setting Up

- Open your charting platform.

- Select your desired asset and timeframe.

- Add the Ichimoku Cloud indicator from the indicator list.

- Adjust the settings if necessary (most platforms use default settings that work well for most traders).

Recommended Settings for Beginners

Stick with the default settings (9, 26, 52) when starting out. These were the original settings developed by Goichi Hosoda and are designed to capture a balance of short, medium, and long-term market movements.

Interpreting Ichimoku Cloud Signals

Interpreting Ichimoku Cloud signals can seem complex at first, but once you understand the basics, it becomes much easier.

Identifying Bullish and Bearish Signals

- Bullish Signal: When the price is above the cloud, and the Tenkan-Sen is above the Kijun-Sen, it’s generally seen as a bullish signal.

- Bearish Signal: Conversely, when the price is below the cloud, and the Tenkan-Sen is below the Kijun-Sen, it’s considered bearish.

The Role of Cloud Thickness in Trend Strength

A thicker cloud indicates stronger support or resistance, making it less likely for the price to break through. On the other hand, a thinner cloud suggests weaker support or resistance, where the price may pass through more easily.

Using Ichimoku Cloud for Support and Resistance

The Ichimoku Cloud isn’t just for trend direction—it also helps identify support and resistance levels. The upper and lower boundaries of the cloud act as dynamic support and resistance, which adjust over time.

Ichimoku Cloud Trading Strategies

Now that you have a good grasp of the Ichimoku Cloud’s components and how to interpret them, let’s look at some trading strategies.

Trend Following with Ichimoku Cloud

One of the most common uses of the Ichimoku Cloud is for trend-following strategies.

Best Practices for Trend Trading

- Look for price to be above the cloud for bullish trends or below for bearish trends.

- Use Tenkan-Sen and Kijun-Sen crossovers to time your entries and exits.

- Confirm with Chikou Span for additional validation.

Swing Trading Using Ichimoku Cloud

Ichimoku Cloud can also be used for swing trading by focusing on shorter-term movements within a broader trend.

Entry and Exit Points

For swing trades, look for moments when the price moves sharply away from the cloud and begins to return—this could be a potential reversal point.

Combining Ichimoku Cloud with Other Indicators

While the Ichimoku Cloud is a powerful tool on its own, it can be even more effective when combined with other indicators like RSI or MACD to confirm signals and reduce false positives.

Common Mistakes to Avoid with Ichimoku Cloud

Despite its power, there are some common pitfalls that traders should avoid.

Overcomplicating the Analysis

The Ichimoku Cloud provides a lot of information, which can be overwhelming. Avoid adding too many other indicators that clutter the analysis and distract from clear signals.

Ignoring Other Market Conditions

While Ichimoku Cloud is great for trending markets, it might not be as effective in choppy or sideways markets. Always consider the broader market conditions before relying solely on the cloud.

Relying Solely on Ichimoku Cloud

Like any tool, the Ichimoku Cloud isn’t infallible. It should be used in conjunction with other analysis methods and risk management strategies.

Advanced Techniques with Ichimoku Cloud

Once you’re comfortable with the basics, you can start exploring more advanced techniques.

Multi-Timeframe Analysis

Using Ichimoku Cloud across multiple timeframes can provide a more robust view of the market. For example, use the daily cloud for trend direction and the hourly cloud for entry points.

Adjusting Settings for Different Markets

Different markets have different characteristics. You can tweak the settings of the Ichimoku Cloud to better suit volatile markets or slow-moving assets.

Conclusion

The Ichimoku Cloud is a versatile and comprehensive tool that can greatly enhance your trading strategy. Whether you’re a trend follower, a swing trader, or somewhere in between, mastering the Ichimoku Cloud can give you an edge in the markets. However, like any indicator, it’s not a magic bullet. It works best when combined with a solid understanding of market fundamentals and a disciplined approach to risk management. So, is Ichimoku Cloud right for you? If you’re ready to add a powerful tool to your trading toolkit, it’s definitely worth exploring.

FAQs

- What timeframes work best with Ichimoku Cloud?

The Ichimoku Cloud can be used on any timeframe, but it’s most effective on daily and weekly charts where trends are more stable. - Can Ichimoku Cloud be used in any market?

Yes, Ichimoku Cloud can be applied to stocks, forex, commodities, and even cryptocurrencies, making it a versatile tool for traders across different markets. - How reliable is Ichimoku Cloud in volatile markets?

While Ichimoku Cloud is robust, it may produce false signals in highly volatile or choppy markets. It’s best to use it alongside other indicators in such conditions. - Is Ichimoku Cloud suitable for beginners?

Absolutely! While it may seem complex at first, with some practice, beginners can quickly learn to interpret its signals and incorporate it into their trading strategies. - What are the best complementary indicators for Ichimoku Cloud?

Indicators like RSI, MACD, and volume can complement the Ichimoku Cloud well, helping to confirm trends and signal reversals.